Opportunities for e-commerce in Eastern Europe

As the global economy continues to develop, companies are increasingly looking for new markets to expand into. Eastern Europe has become an increasingly attractive destination for many companies, thanks to its relatively untapped potential and favorable business climate. If you're looking for e-commerce opportunities in Eastern Europe, you've come to the right place. In this comprehensive guide, we explore opportunities in a number of Eastern European countries: Bulgaria, Czech Republic, Hungary, Poland, Romania, Slovakia.

E-commerce in the Czech Republic

The Czech Republic has more than 10 million residents and a highly educated workforce. The country is also home to a number of large companies, including Skoda, Volkswagen and DHL. The Czech Republic has a well-developed infrastructure and is a member of the European Union. These factors make the Czech Republic an increasingly attractive destination for e-commerce companies.

According to Statista data, the Czech e-commerce industry will be worth about €7 billion in 2022 and is predicted to be worth about €9.5 billion by 2025. Czech e-commerce accounts for 13 percent of the country's retail sales.

Of the 10 million people living in the Czech Republic, nearly 6 million can be considered online shoppers, which will rise to about 7 million by 2025. When it comes to payment methods, the Czech Republic is known for the high use of cash. Thus, payment on delivery is still the most popular payment method, accounting for about 40 percent of transactions. Bank transfers account for nearly 30 percent of transactions.

E-commerce in Hungary

Located in Central Eastern Europe, Hungary has a population of more than 10 million. Hungary's growth was strong in the pre-covid years and it is a member of the European Union, although its political leaders often teeter on the edge of what the EU allows. Hungarian is the official language, but English is also widely spoken. Hungary offers a number of advantages for e-commerce companies, including a favorable tax climate and a well-developed infrastructure.

According to Statista data, the Czech e-commerce industry will be worth about 4.5 billion euros in 2022 and is predicted to be worth about 7 billion euros by 2025.

The number of e-commerce customers in Hungary is growing rapidly, especially in recent years. This is driven by growth in Internet use (2020: 85 percent of Hungarians are Internet users) and cashless payments, such as mobile payments and electronic banking, becoming more popular and user-friendly. Between 2016 and 2021, Hungary experienced one of the biggest growth spurts in online shoppers in the European Union. The share of Internet shoppers grew by 26 percentage points, Eurostat reports. More than 70 percent of people made an online purchase at least once.

When shopping online, the majority of Hungarians (45 percent) prefer payment without cash, such as credit and debit cards. For example, customers can pay the courier by card. However, cash on delivery is also still popular. These two options are also the most available in online stores in Hungary. Courier delivery has been the most popular shipping method for years, chosen by 80 percent of shoppers. For 38 percent, pickup points are preferred, while 36 percent choose regular mail delivery. Parcel vending machines are also becoming increasingly popular in Hungary, chosen by 27 percent of respondents. When choosing a delivery option, shipping costs are the most important factor for Hungarians.

E-commerce in Poland

Poland is a large country of more than 38 million people. Poland has a diversified economy and is a member of the European Union. Polish is the official language, but English is also widely spoken. Poland offers a number of advantages for e-commerce companies, including a large market, a well-developed infrastructure and a favorable tax environment.

Read more about E-commerce in Poland in another blog.

E-commerce in Romania

Romania is a country of more than 19 million people. Romania has a diversified economy and is a member of the European Union. Romanian is the official language, but English is also widely spoken. Romania offers a number of advantages for e-commerce companies, including a large market, a well-developed infrastructure and a favorable tax environment.

By 2020, Romania had 15.35 million Internet users, representing more than 78 percent of the population. According to DataReportal, 78 percent of Romanians visited store websites and 70 percent made online purchases at least once in 2020. Although most Romanians use a cell phone to access the Internet (87 percent), more than half of online orders are still done through a laptop (54 percent).

As much as 95 percent of orders are placed with national sellers. Although a study by GPeC reports that almost a third of Romanians prefer to buy from Chinese stores (27 percent) or other EU member states (23 percent). This is also why AliExpress ranks high among the top online stores in Romania.

Romania's e-commerce market generated $3.2 billion in revenue in 2021. That year, online retail grew 11 percent year-on-year to a market volume of 6.2 billion euros, according to the European E-commerce Report 2022. According to Statista, the market is expected to grow at a compound annual growth rate of 16 percent between 2022 and 2025.

E-commerce in Slovakia

Slovakia is a small country with a population of about 5.5 million. Slovakia has a diversified economy and is a member of the European Union. Slovak is the official language, but English is also widely spoken. Slovakia offers a number of advantages for e-commerce companies, including a well-developed infrastructure and a favorable tax environment.

According to Statista data, the Slovak e-commerce industry will be worth about 2.5 billion euros in 2022 and is predicted to be worth about 4 billion euros by 2025. Of the 5.5 million people living in Slovakia, nearly 3 million can be considered online shoppers, which will rise to about 3.1 million by 2025.

For Slovaks, price is still the most important factor when buying a particular product. Nevertheless, there are more and more lovers of high quality, despite the high price. This is related to the increase in income in this country. Consumer awareness is also increasing. Slovaks are increasingly checking the ingredients and origin of products. A typical Slovak customer looks first at the price tag, then at the carrier, and finally he is lured by the added value in the form of a discount.

The most important payment method for Slovaks is the cell phone. This is followed by prepaid cards. Third place with 17% of the market share is for credit cards. Bank transfers and e-wallets account for the fewest transactions - 2% and 3%.

The largest sector in Slovak e-commerce is fashion. It generates 37% of this country's e-commerce revenues. This is followed by Electronics & Media. This sector accounts for 28% of e-commerce revenues.

Tip: The credibility of online stores is high in Slovakia, but a common obstacle to online shopping is the strong habit of trying out goods in person. Offer them a similar shopping experience and impress them with free shipping and price benefits they won't find in physical stores.

E-commerce in Bulgaria

Bulgaria is a country in southeastern Europe with a population of about 6.9 million. It borders Romania to the north, Serbia and Macedonia to the west, Greece and Turkey to the south and the Black Sea to the east. The Bulgarian e-commerce market generated about $1 billion in revenue in 2021 and by 2025 e-commerce in Bulgaria is expected to reach a market volume of $1.588 billion.

According to the 2022 European E-commerce Report, more than half of Bulgarians (56 percent) have shopped online in the past three months. In Bulgaria, more than 60 percent of the population has a smartphone. Yet online shopping still mainly takes place on desktop computers with 59 percent of purchases in 2022, Statista reports. Young people order most via cell phones.

In terms of payment methods, most online consumers pay by cash on delivery. According to payment provider Ppro, as many as 67 percent of ecommerce payments are made with cash. Credit cards and e-wallets are also popular, both accounting for 15 percent of online purchases.

To drive Bulgarian traffic to your website, local marketing & SEO will be essential, but to do this effectively you need to translate your store for the Bulgarian market. This is very easy with Clonable. With a translated version of your store, you can have your store indexed in Bulgarian search engines, generating free organic traffic. Another great and very effective way to generate good quality qualified traffic is Google Ads.

Conclusion: e-commerce and doing business in Eastern Europe

- Eager customers, little competition

Unlike mature markets such as Germany or the United Kingdom, the Eastern European e-commerce market is still in its infancy. Few if any local competitors serve a growing number of young, Internet-loving shoppers. It's the perfect time for you to jump in.

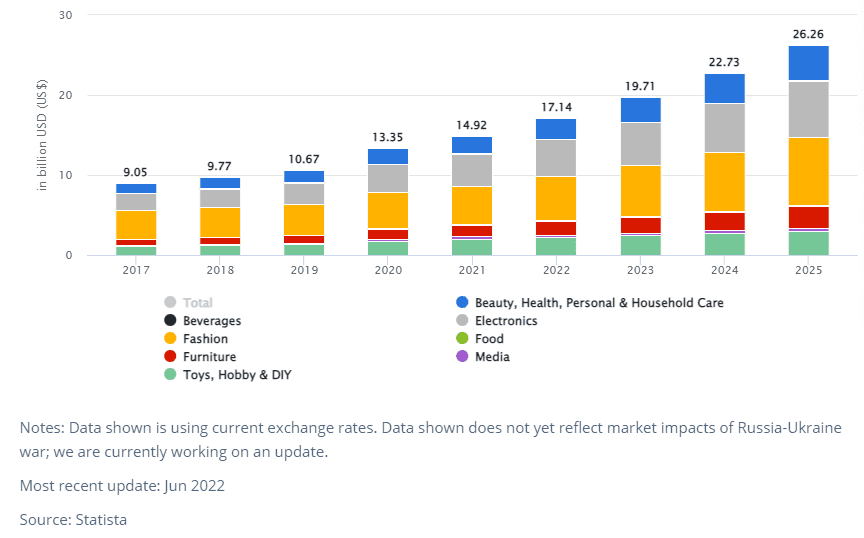

- Rapid growth (better than Western Europe)

While the Western European market is larger, Eastern Europe is growing faster, with nearly 30% growth by 2020.

- A long, happy road ahead

ECommerce penetration in Eastern Europe was only 41% in 2020. Compare that to the huge 86% in Western Europe, where shoppers are much more entrenched. The eCommerce market still has plenty of room to grow in Eastern Europe - take Poland, for example, where a $29.6 billion eCommerce market is expected to grow to $47.1 billion by 2025.